Situation

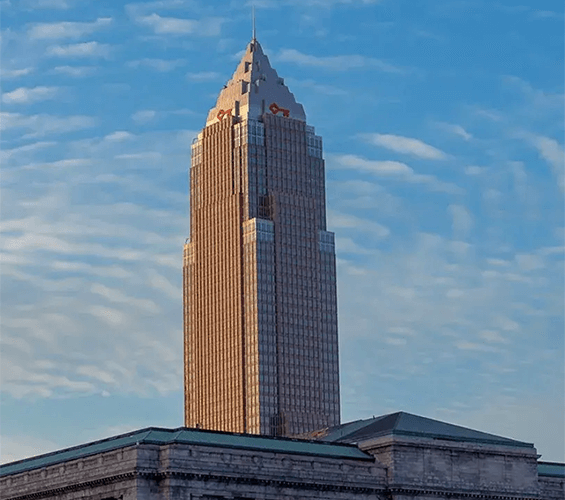

JLL brokers were strategizing to find the best solutions to help lease Key Tower, owned by The Millennia Companies. Located in the heart of Cleveland, Ohio, Key Tower offers 1.3 million square feet of Class A office space. As the tallest building in the state, Key Tower has the capacity to partner with firms of all sizes. To attract those companies, the JLL brokers implemented RealtyAds.

Solution

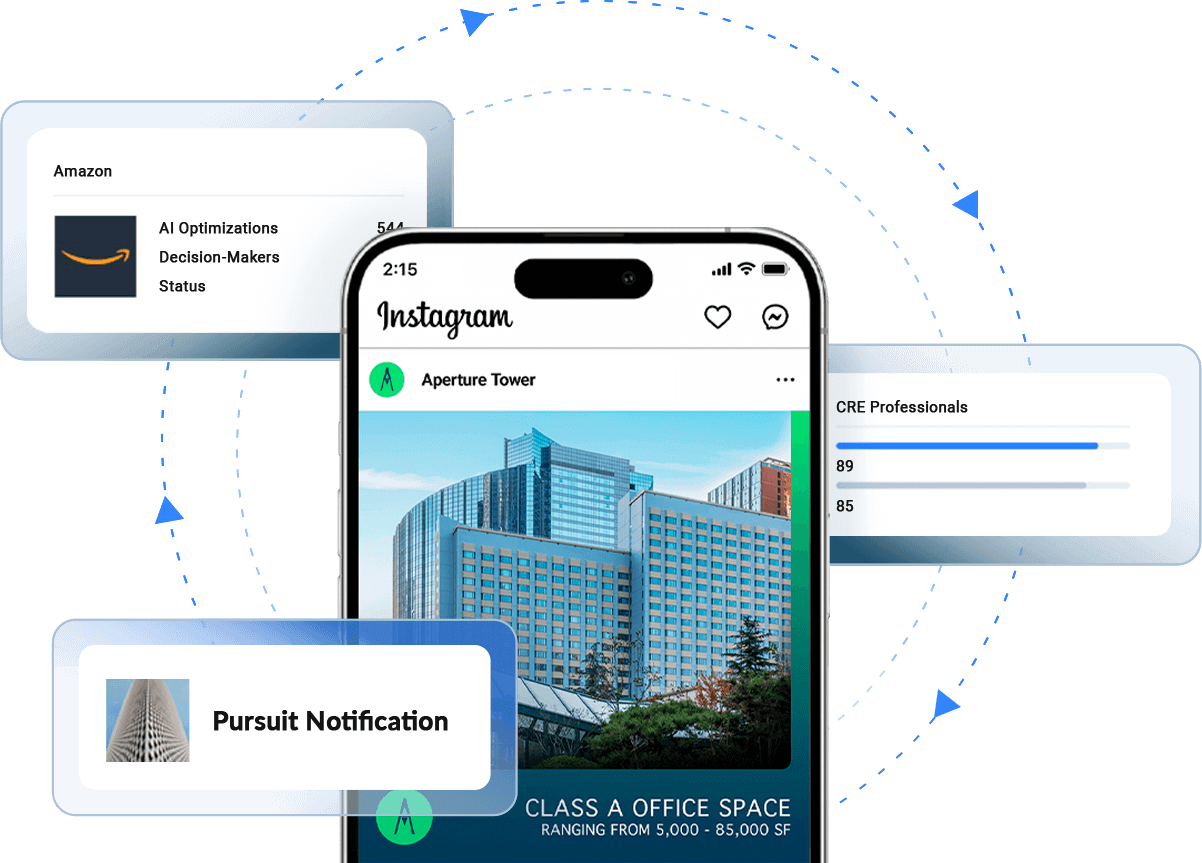

RealtyAds’ AI is designed to find, advance, and close more deals. The AI launches, manages, and optimizes an asset’s online presence while prioritizing spend toward targeted critical audiences. The JLL brokers for Key Tower recognized that they could better facilitate leasing by implementing a leasing enablement plan with RealtyAds. Their goal was to improve their reach to critical end-users considering Key Tower and ultimately advance those deals.

A common misconception about digital advertising is that CEOs, CFOs, and other C-suite decision-makers do not use these popular platforms. However, according to JP Morgan’s findings, more than 88% of decision-makers use social media. Moreover, in today’s business world, social media is essential for staying informed within an industry—so why not market to these decision-makers where and when they prefer to spend their time?

Result

In the first 12 months of maintaining an active digital presence with RealtyAds, JLL and Millennia began to see closed deals that were directly influenced by their digital strategy. The marquee success was Benesch Law, which resulted in the largest transaction in recent market history.

So how did RealtyAds assist?

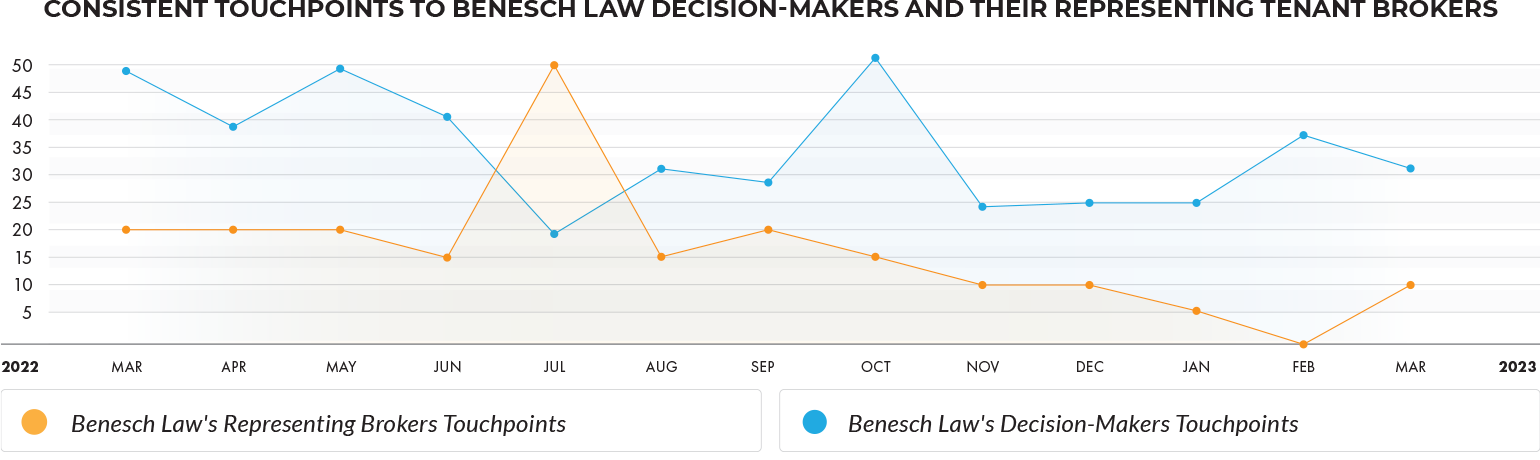

Throughout the entire deal cycle, Key Tower’s digital presence remained in front of critical audiences, reaching the tenant advisors representing Benesch Law more than 200 times. This continuous exposure enabled an efficient transition through each deal stage and consistently reminded Benesch Law of the opportunity at Key Tower. While tenant advisors play a crucial role in influencing deals, they are only one of two key audiences properties need to reach. The other is decision-makers at firms considering the asset.

Leveraging the targeting features included in their RealtyAds service, JLL added their “tenants in the market” list and active pipeline of companies—including Benesch Law’s decision-makers. This helped RealtyAds’ artificial intelligence (RITA) recognize that the law firm was a high-priority tenant, ensuring that spend was prioritized toward reaching top decision-makers at the firm.

Throughout the pursuit, RealtyAds’ AI successfully reached Benesch Law’s C-suite executives more than 400 times with Key Tower’s messaging. This ensured that top decision-makers were repeatedly viewing the asset, fully aware of its enhanced offerings, and not just being presented with an impersonal economic comparison through a tenant rep’s matrix.

Midway through the proposals with Benesch Law, we added them to our Company Targeting list on RealtyAds. We believe the touchpoints to key decision makers and their representation throughout the sales cycle kept Key Tower top of mind as they evaluated our asset.”

Senior Vice President | JLL

The end result of the leasing teams, asset managers, and RealtyAds efforts was an eight-floor deal (165,000 SF) worth an estimated $35,000,000.

Takeaway

To provide value, leasing strategies must be both innovative and effective in commercial real estate. Too often, however, leasing and marketing teams rely on antiquated channels that are neither innovative nor capable of finding, advancing, or closing deals.

Brokers who pair their market expertise with RealtyAds leasing enablement technology create the most advanced go-to-market strategy in commercial real estate today. By combining expertise with essential software, leasing agents have increased their reach to tenant reps by more than 80% each month and, for the first time, gained the ability to proactively engage key decision-makers at every stage of the deal.

In the ultra-competitive landscape of commercial real estate, this case study highlights that those who modernize their leasing strategies are often rewarded with improved leasing velocity.