The U.S. industrial commercial real estate (CRE) sector is undergoing a significant shift in 2025. Once considered the strongest asset class coming out of the pandemic, industrial is now grappling with rising vacancies, slower rent growth, and lingering oversupply. Landlords who once had the luxury of being selective about tenants are now prioritizing occupancy, often loosening lease terms and offering incentives to fill space.

Market Shift: From Full Occupancy to Scramble for Tenants

At the peak of the industrial boom in 2021–2022, demand was fueled by e-commerce expansion, supply chain diversification, and reshoring trends. Vacancy rates reached record lows, and rents rose quickly. But the tide has turned. According to CommercialEdge’s March 2025 report, the national industrial vacancy rate has climbed to 8.2%—a figure not seen in over a decade. Meanwhile, year-over-year rent growth has cooled to just 2%, a stark contrast to the double-digit increases seen just a few years ago.

Oversupply and Demand Lag

A major contributor to the sector’s softening is the wave of new construction that flooded the market over the past 18–24 months. In 2024 alone, over 330 million square feet of industrial space was delivered, much of it speculative. Developers were betting on sustained demand, but tenant activity has not kept pace. This imbalance is particularly pronounced in high-growth markets such as Dallas, Phoenix, and the Inland Empire, where large blocks of space are sitting vacant and leasing has slowed considerably.

Changing Leasing Behavior

As a result, landlords are adjusting their strategies. Where they once targeted national credit tenants with long-term leases, today’s focus is on flexibility and occupancy. Many owners are now open to shorter lease durations, are offering larger tenant improvement packages, and are deploying more aggressive concessions, such as free rent periods or renewal options, to get deals done. In today’s market, filling space is often prioritized over maximizing rent.

Tariff Pressures Add Complexity

Adding to the challenge is a new wave of tariffs that are rippling through the U.S. supply chain. In February 2025, the current administration announced expanded tariffs on Chinese goods, including electric vehicles, batteries, and steel. According to the Wall Street Journal, these tariffs are part of a broader economic strategy, but they’re already impacting industrial demand.

Import volumes at major U.S. ports have declined, which affects the need for warehousing and distribution space. At the same time, manufacturers reliant on imported materials are facing higher costs, which has caused some to pause expansion plans. While tariffs aren’t the leading cause of the industrial slowdown, they are a contributing factor, especially in port markets and manufacturing-heavy regions.

Regional Variations

The effects of this market shift aren’t evenly distributed. Markets with more disciplined development pipelines, such as Kansas City and Indianapolis, remain relatively balanced. But in high-growth areas that saw aggressive speculative construction, especially in the Southeast and on the West Coast, the competition for tenants is intense. In those markets, landlords are feeling the pressure to adapt quickly or risk prolonged vacancy.

Outlook: Stabilization Ahead?

Many industry analysts are hopeful that the market will begin to stabilize in the second half of 2025. With new construction starts slowing and demand likely to rebound modestly, the imbalance may correct over time. But for now, it’s clear that the industrial sector is in a transition period. Owners are shifting from being picky to being pragmatic, redefining success in terms of leased space rather than perfect tenant profiles.

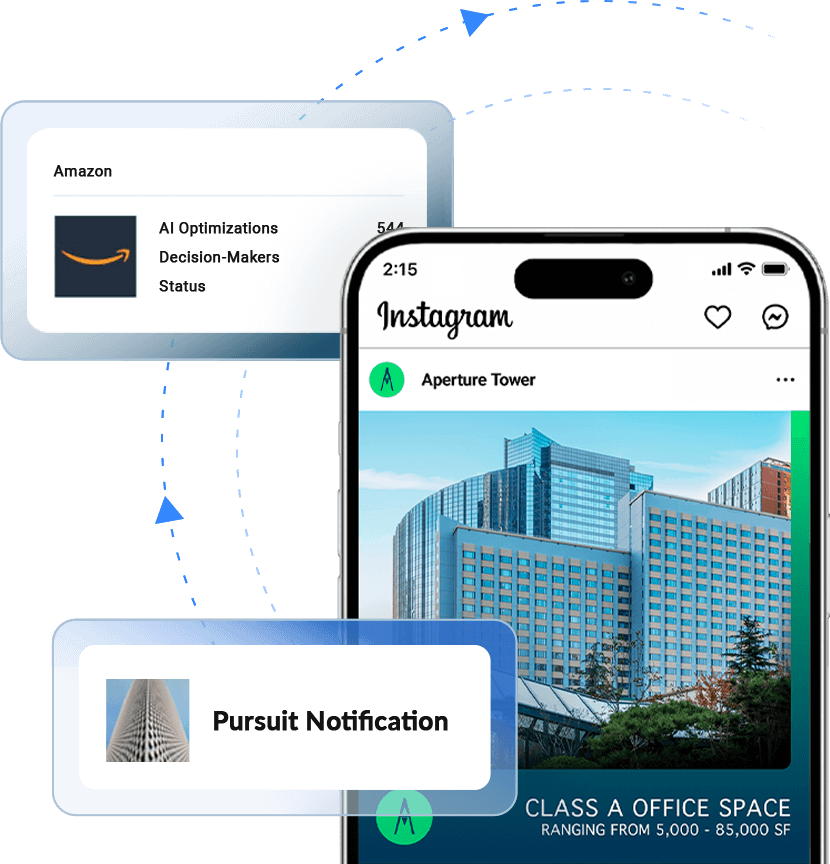

RealtyAds is helping commercial real estate find, advance, and close more deals by engaging decision-makers and their representation on the world’s most effective customer acquisition channels. For more information, visit RealtyAds.com and follow RealtyAds on LinkedIn, Facebook, and Instagram.