Commercial real estate teams have more market data than ever—yet many are still reacting too late.

Quarterly reports, market recaps, and anecdotal insights remain valuable, but they weren’t designed for a leasing environment where demand forms digitally and shifts in weeks, not quarters. By the time trends appear in traditional reports, opportunities have often already passed.

This is where AI is changing how CRE teams track market trends.

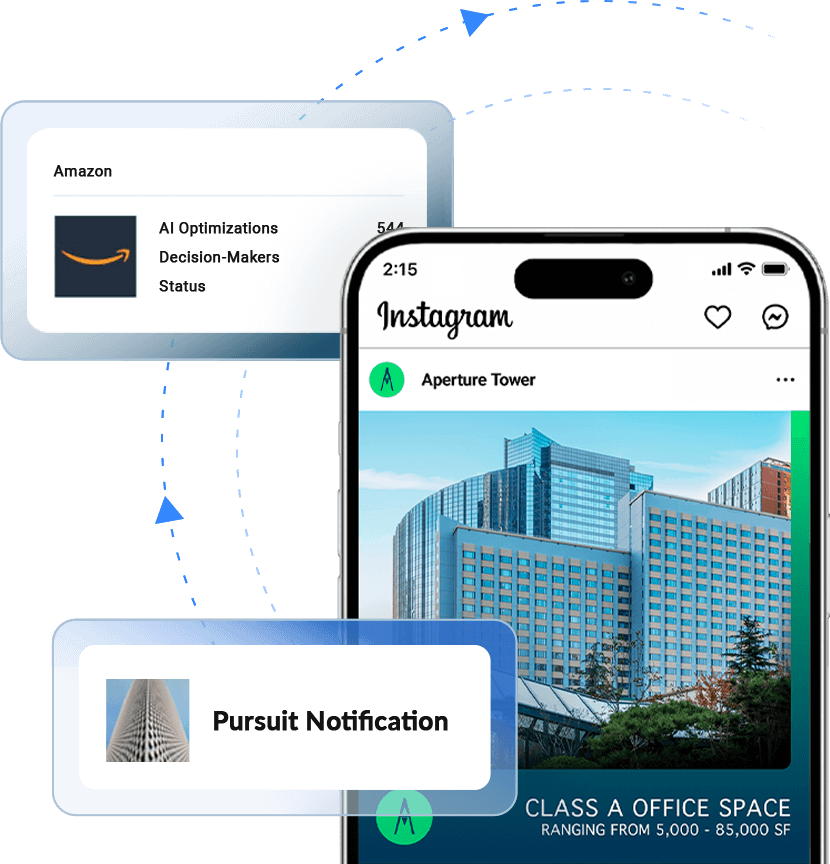

Instead of relying solely on static research, AI analyzes real-time engagement, search behavior, and digital activity to surface early signals of demand. The result is faster visibility, clearer prioritization, and better decision-making in a market where timing increasingly defines performance.

From Static Reports to Continuous Market Intelligence

Traditional market research is backward-looking by design. While reports remain essential for understanding macro conditions, they often reflect trends after they’ve already impacted deal velocity.

AI changes the model by analyzing:

- Real-time digital engagement

- Search behavior and content consumption

- Listing interaction across markets and asset types

This allows teams to spot movement earlier, before demand shows up in absorption or signed leases. According to McKinsey, organizations using advanced analytics are significantly more likely to outperform peers in decision speed and accuracy, a competitive advantage in long CRE sales cycles.

Tracking Demand Before the Tour

One of the most meaningful shifts AI enables is visibility into pre-tour demand. Tenant and broker interest now forms online well before a call or site visit.

AI-powered platforms surface insights such as:

- Which tenant profiles are engaging with specific assets

- How interest is shifting by geography or use case

- Where marketing visibility is influencing consideration

Deloitte reports that over 70% of commercial real estate firms are either piloting or actively using AI and advanced analytics, largely to better understand customer behavior and market movement earlier in the funnel.

Turning Engagement Data into Market Signals

Engagement data alone isn’t new. What’s new is AI’s ability to interpret it at scale.

Instead of manually reviewing dashboards, AI identifies patterns across thousands of interactions, highlighting what matters and filtering out noise. This helps CRE teams:

- Distinguish real demand from passive interest

- Measure momentum across assets and portfolios

- Adjust strategy before listings lose visibility

The result is trend tracking that’s tied to performance, not just observation.

Better Forecasting, Fewer Assumptions

AI also improves forecasting by combining historical performance with live market signals. Rather than assuming past cycles will repeat, teams can model scenarios based on current behavior.

According to PwC, AI-driven forecasting improves planning accuracy and reduces reliance on assumptions, critical in a market defined by uneven recovery and asset-specific performance.

Conclusion

AI isn’t replacing market expertise; it’s enhancing it. The most effective teams still rely on experience, local knowledge, and relationships. AI simply ensures those decisions are informed by what’s happening now, not what happened last quarter.

As CRE becomes more digital and data-driven, the ability to track trends in real time is no longer a nice-to-have. It’s a competitive advantage.

Teams that adopt AI-enabled market intelligence gain earlier visibility, stronger positioning, and faster execution—exactly what today’s leasing environment demands.