Distressed property investments are quickly becoming a focal point for commercial real estate (CRE) investors looking to uncover value in a market still finding its footing. As asset valuations continue to adjust and traditional financing channels tighten, opportunistic capital is flowing toward properties available at significant discounts.

Major Capital Flows Signal Confidence

One of the clearest signals of this shift: the record-setting activity among major investment firms. According to Brookfield Asset Management, $5.9 billion was raised in the first quarter of 2025 for its latest real estate opportunity fund—part of a total $16 billion vehicle focused on acquiring distressed assets. The fund has already deployed nearly 25% of its capital, targeting properties such as foreclosed multifamily buildings and undervalued logistics infrastructure.

These investments aren’t isolated. CRE-focused private equity funds collectively raised $57.1 billion in Q1 2025, compared to $32.5 billion in the same period last year. The growth reflects a clear resurgence of interest in distressed and opportunistic assets—especially among firms anticipating long-term value recovery.

Why Investors Are Paying Attention

Current market conditions are creating opportunities that haven’t been this accessible in over a decade. Property owners under pressure from lenders may look to offload underperforming or over leveraged assets. For opportunistic buyers, this translates into deals at 20–40% below peak valuations, with upside potential if the market rebounds.

Even international platforms are in play. Brookfield’s acquisition of Tritax EuroBox, a logistics firm valued at over $1.4 billion, reflects how global capital is being deployed to capture strategic, long-term assets at a discount.

What This Means for CRE Stakeholders

For owners, the increase in capital targeting distressed assets may create opportunities to exit challenging investments or recapitalize with new partners. For investors, it’s a chance to acquire quality assets below replacement cost, while repositioning portfolios for future growth.

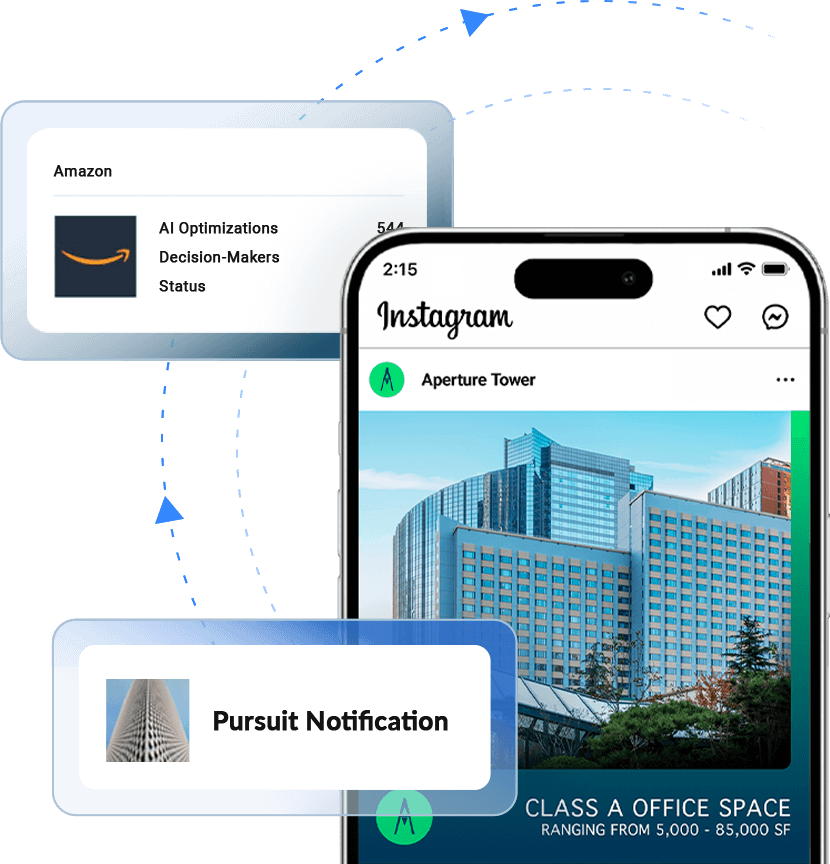

And for brokers and marketers, it’s a reminder that speed, exposure, and strategic positioning are critical when distressed assets hit the market. Leveraging platforms like RealtyAds ensures your listings reach the right buyers—fast.

Stay Ahead of CRE Market Shifts

As firms double down on opportunistic strategies, keeping pace with investor behavior and emerging trends is key. For more insights on how digital marketing and data-driven strategy intersect with CRE investment, visit RealtyAds.

RealtyAds is helping commercial real estate find, advance, and close more deals by engaging decision-makers and their representation on the world’s most effective customer acquisition channels. For more information, visit RealtyAds.com and follow RealtyAds on LinkedIn, Facebook, and Instagram.