The U.S. office market in 2025 presents a complex landscape, one marked by cautious optimism but tempered by structural challenges. While certain indicators suggest a rebound, others point to persistent headwinds that could cap recovery.

Signs of Stabilization

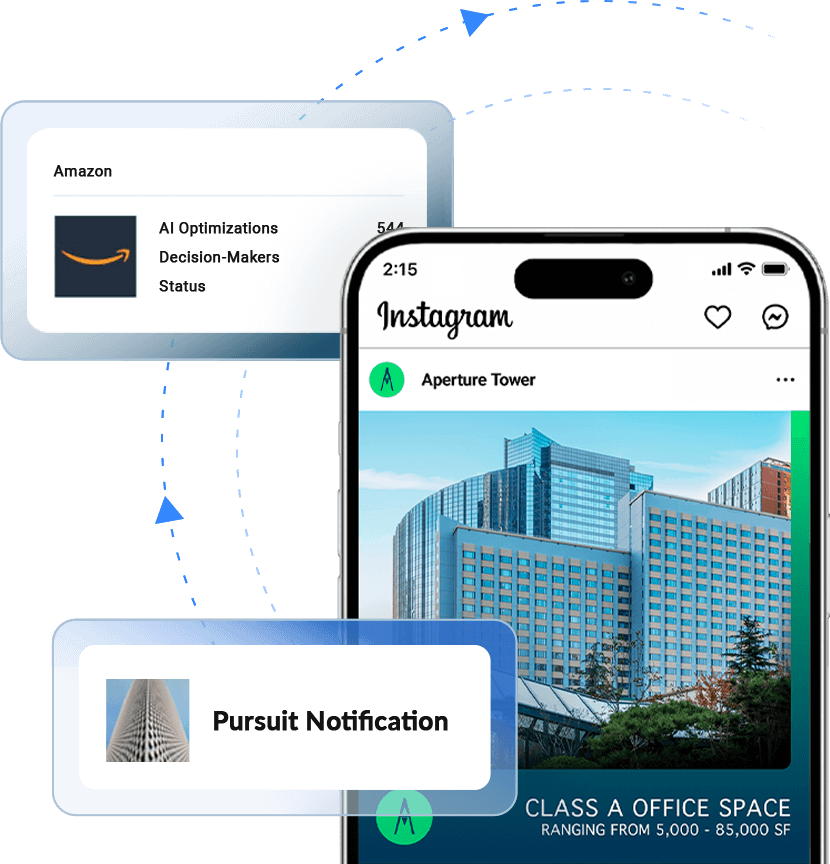

Leasing activity in Manhattan has surged, with August 2025 recording 3.7 million square feet leased, a 20% increase over July and well above the city’s 10-year average. If this pace continues, the year could close with over 40 million square feet leased, matching pre-pandemic levels. This growth is driven by a strong job market, increased return-to-office momentum, and renewed interest from industries such as tech and legal services. Notably, Amazon has secured over a million square feet since late 2024, and law firms reached a record-breaking 4 million square feet in 2023.

Nationally, net absorption turned positive in the second and third quarters of 2024, signaling a potential shift toward demand growth. Tenant demand remains strong, with a healthy pipeline of tenants actively seeking office space expected to drive a 5% rise in leasing volume in 2025. Smaller tenants are accounting for more than half of total leasing volume, indicating a broad-based recovery.

Structural Challenges Persist

Even with these positive signs, structural challenges persist. The national office vacancy rate surged to an unprecedented 20.7% in the second quarter of 2025, signaling a structural disruption rather than a temporary downturn. This surplus of empty space is creating pressure on property values and straining the balance sheets of regional banks that hold a lot of commercial loans.

New office construction is also declining, with deliveries projected to hit a 13-year low of 13 million square feet in 2025. Most of this construction is concentrated in high-growth Sun Belt markets, leaving other regions with limited new supply. Additionally, tenant improvement allowances are averaging 68% above pre-pandemic levels across leading office markets, indicating that landlords are offering significant incentives to attract tenants.

What This Means for You

For investors, the current market presents both opportunities and risks. While certain markets show promise, particularly those with strong tenant demand and limited new supply, others are facing significant challenges. Tenants may find favorable leasing terms in markets with high vacancy rates but should consider factors such as location, building quality, and long-term flexibility.

While there are signs of a rebound, challenges remain that could limit growth. Stakeholders should approach the market with a balanced perspective, recognizing both the opportunities and risks ahead.