In commercial real estate, every budget decision comes down to one question: What’s the return? Owners want to know if an investment, especially in AI and digital strategies, will create measurable value. For many teams, the challenge isn’t whether AI works. It’s proving the results in a way that secures buy-in and internal support.

Here’s how to frame the business case, track ROI, and report impact so that AI becomes an investment, not an expense.

Step 1: Define ROI in Terms That Matter to CRE

ROI isn’t abstract. In CRE, it connects directly to outcomes that drive asset performance. Start by aligning your AI strategy with metrics that owners care about most:

- Vacancy reduction: Shortening downtime between tenants directly improves NOI. For instance, if a month of vacancy in a 50,000 SF space costs over $1.5M, even a slight improvement in leasing speed yields substantial returns.

- Leasing velocity: Measuring how quickly qualified tours are converted into executed leases indicates whether your digital initiatives are generating momentum. Faster leasing velocity is a clear signal that marketing spend is working.

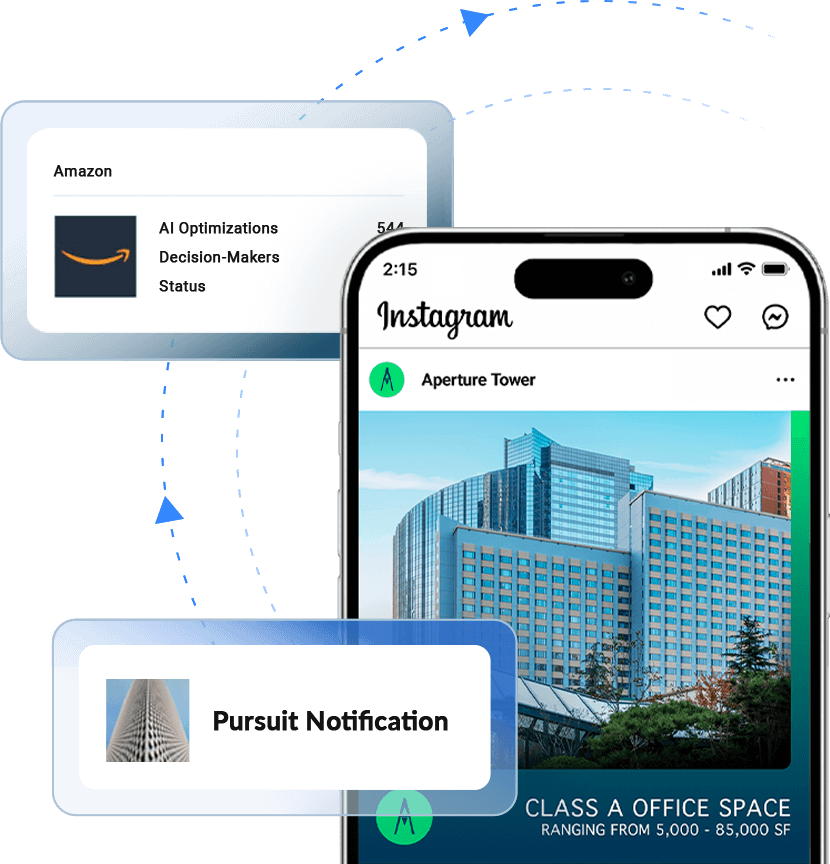

- Prospect engagement and tenant demand: Track not just the number of inquiries, but also the quality. AI-driven programs should connect with decision-makers, executives, asset managers, or heads of real estate who can act.

And the upside isn’t hypothetical. Research shows that real estate organizations adopting machine learning have boosted NOI by up to 10%. That kind of lift has a direct impact on property valuations.

Step 2: Use a Framework for Measuring ROI

When evaluating AI and digital spend, structure your analysis around three dimensions:

- Efficiency: How much time or cost is saved by automating targeting, outreach, or reporting?

- Effectiveness: Are strategies reaching the right audience and generating meaningful engagement?

- Outcome: What measurable impact does the approach have on leasing results and property performance?

For example, an AI-driven strategy might cut broker manual outreach by 30% (efficiency), deliver ads directly to CFOs and CEOs (effectiveness), and help fill space 45 days faster than traditional methods (outcome). Together, these metrics create a complete ROI picture.

This framework reflects what early adopters across industries are already proving: AI delivers a return. In fact, organizations report earning $1.41 back for every $1 spent, a 41% ROI through a mix of cost savings and incremental revenue.

Step 3: Report Results the Way Decision-Makers Expect

Owners aren’t looking for vanity metrics. They want clear, bottom-line reporting that connects spend to results. When sharing outcomes:

- Quantify in dollars: Translate digital performance into financial impact. For example, “This strategy reduced vacancy by one month, avoiding $1.5M in lost rent.”

- Highlight time saved: Show how AI shortens cycles for leasing, reporting, or approvals. Faster time-to-lease means faster revenue.

- Show scalability: Demonstrate how the approach works across multiple assets or portfolios, not just one-off successes.

What This Means for You

Proving ROI on AI in CRE isn’t about producing flashy charts. It’s about linking digital strategies to the fundamentals of real estate performance: reduced vacancy, faster leasing, and stronger pipelines.

With the right framework and reporting, AI shifts from a “nice-to-have” experiment to a proven driver of asset value. And once decision-makers see the numbers, securing buy-in for future budgets becomes far easier.

Owners and executives invest in results. AI can deliver them. The key is telling the ROI story in their language—clear, financial, and tied directly to asset performance.