At RealtyAds, we sit at the intersection of commercial real estate and digital strategy, giving us a front-row view of how the market is evolving. Across office, industrial, retail, and multifamily sectors, the data tells a clear story. Here’s what we’re seeing—and how owners and leasing teams can stay ahead.

Office: Flight to Quality Continues

Office vacancy remains elevated at 19.1% nationally as of Q1 2025, according to CBRE. While tenants continue to downsize or delay leasing decisions, Class A assets in top-tier submarkets remain stable. In some gateway cities, net effective rents for these buildings are even trending upward. The trend is clear: hybrid work is here to stay, and tenants are opting for less space, but better space. Landlords with newly renovated or amenity-rich properties are best positioned to win those deals. With demand becoming increasingly selective, it’s never been more important to market these differentiators through a targeted digital strategy.

Industrial: Normalizing After Record Highs

After years of outperformance, the U.S. industrial sector is starting to normalize. Vacancy rates have edged up slightly to 6.3% per CBRE and 7.3% according to JLL, but remain within pre-pandemic norms. Meanwhile, construction starts have dropped approximately 30% year-over-year, signaling a slowdown in new development. This isn’t a downturn—it’s a reset. As more options become available to tenants, leasing success will depend on how early and how often your space shows up in their decision-making process.

Retail: Resilience in Local and Experiential

Retail continues to outperform expectations. According to CBRE, availability ticked up slightly to 4.8% in Q1 2025, but remains among the lowest levels seen in over a decade. Experiential and service-based tenants are expanding, particularly in mixed-use developments and lifestyle centers. Demand is being driven by local relevance and walkability—proof that physical retail is evolving, not fading. For owners, the takeaway is clear: showcasing your location, tenant mix, and value proposition through digital branding is essential to attract the right operators.

Multifamily: Supply Surge Meets Steady Demand

Multifamily is experiencing a historic wave of new deliveries, with over 500,000 units expected to come online in 2025, according to RealPage. Rent growth is softening in high-supply metros, especially across the Sunbelt, but demand remains healthy. In this environment, competition among properties is intensifying. That means it’s not just about offering a quality product—it’s about getting in front of the right renters before your competitors do. A strong digital marketing strategy isn’t optional; it’s a requirement for lease-up success

Final Thought: In Every Market, Visibility Wins

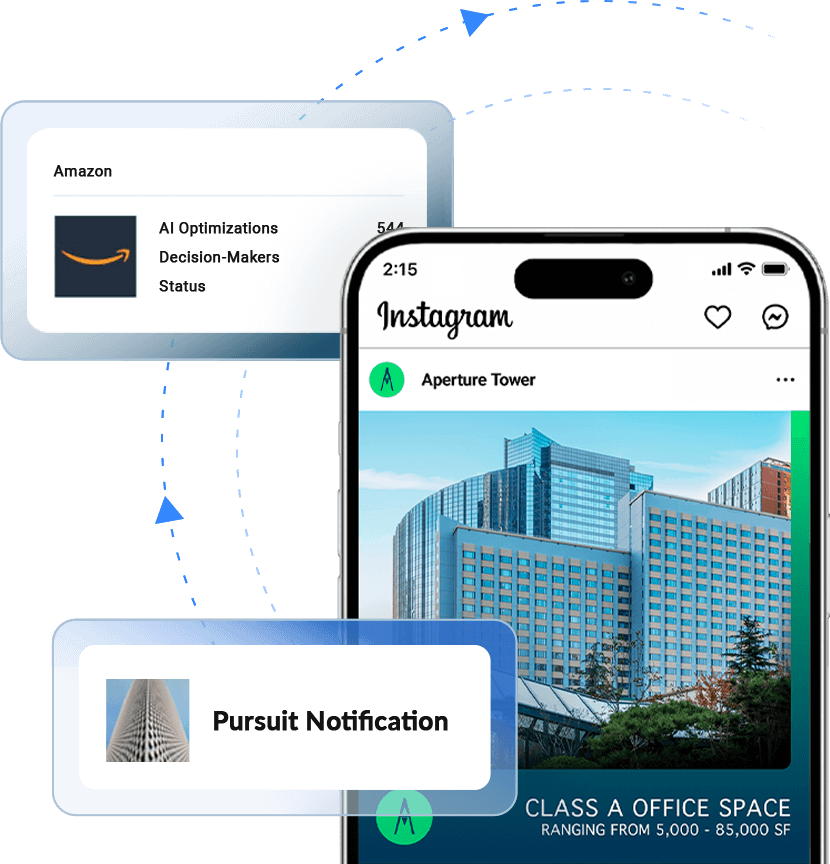

Whether you’re leasing office floors in Chicago or filling apartments in Miami, one thing remains true: visibility drives velocity. RealtyAds helps CRE teams cut through the noise with hyper-targeted advertising across platforms like LinkedIn, Google, and Instagram. Let the data guide your strategy—and let RealtyAds help you execute it with precision.

RealtyAds is helping commercial real estate find, advance, and close more deals by engaging decision-makers and their representation on the world’s most effective customer acquisition channels. For more information, visit RealtyAds.com and follow RealtyAds on LinkedIn, Facebook, and Instagram.