Commercial real estate remains a globally interconnected market—more so in 2025, as shifting economic dynamics and evolving investor behaviors reshape where capital flows. For brokers, asset managers, and developers, understanding these trends is vital to maintaining a competitive edge in an increasingly complex landscape.

Why Global Capital Still Matters

Global capital is a barometer for market confidence. In 2025, several forces are shaping global CRE investment patterns:

- Economic Stability & Diversification: The U.S. continues to attract capital for its stability and transparent markets. Over the trailing 12 months, American commercial real estate accounted for 38% of global transaction activity.

- Cross-Border Momentum Rebounds: According to JLL, cross-border CRE investment rose 21% year-over-year in the first half of 2025. The Asia-Pacific region led this growth, with an 87% increase, followed by 28% in the Americas and 6% in EMEA.

- Capital Shifts by Sector: Multifamily assets now hold the top spot in global investment preferences, with industrial following closely—reflecting continued demand for resilient asset types.

Implications for CRE Teams

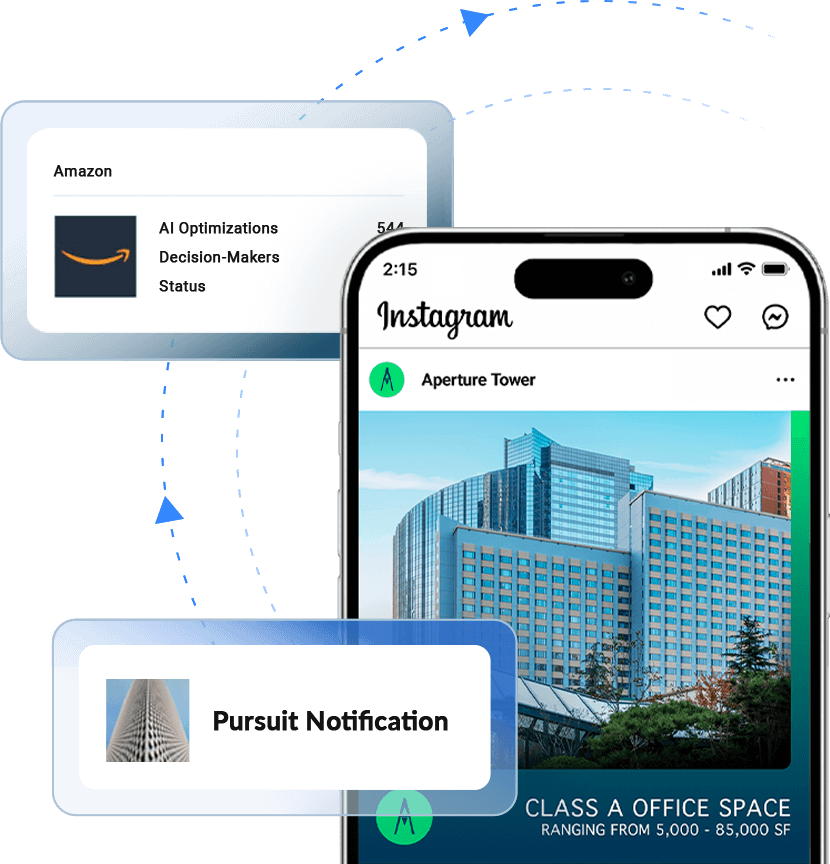

- Targeting Global Buyers: Traditional out reahc is no longer sufficient alone. Winning attention from overseas capital, especially from sovereign wealth funds and institutional investors, requires a global digital strategy tailored to specific channels and markets.

- Highlighting Resilient Sectors: Investors are gravitating toward assets with strong fundamentals—multifamily, logistics, and life sciences top the list. Positioning listings clearly around these strengths is increasingly important.

- Elevating Transparency & ESG: Global investors expect robust reporting, sustainability credentials, and standardized governance practices. For asset managers, building these into reporting frameworks offers distinct competitive advantage.

Down the Digital Path

Capital isn’t just flowing, it’s flowing strategically. Platforms like RealtyAds help CRE professionals to target global decision-makers with precision. You can reach investors in New York, London, or Toronto using strategic digital outreach, without relying solely on traditional efforts.

Global CRE capital is not stagnant, it’s being redirected to where value is clear and risk is managed. CRE teams that adapt their outreach, storytelling, and operational practices to this changing landscape will be best positioned to capture the next wave of opportunity.