Class A office leasing showed real momentum in 2025. Leasing activity rose 12.5% year over year—the strongest performance the sector has seen since 2019. National vacancy improved, prime inventory tightened, and flight-to-quality remained intact.

But beneath the headline growth, a more important story emerged.

Not every Class A asset benefited from this rebound. In fact, the gap between top-performing buildings and the rest of the market widened, often dramatically. The difference wasn’t location, amenities, or even pricing strategy. It was visibility.

The Market Isn’t Soft—It’s Selective

On paper, Class A fundamentals look encouraging. New construction has slowed significantly. Tenants continue to favor high-quality, well-located space. Demand exists, but it’s concentrated. What changed in 2025 wasn’t whether tenants were leasing. It was how they evaluated options.

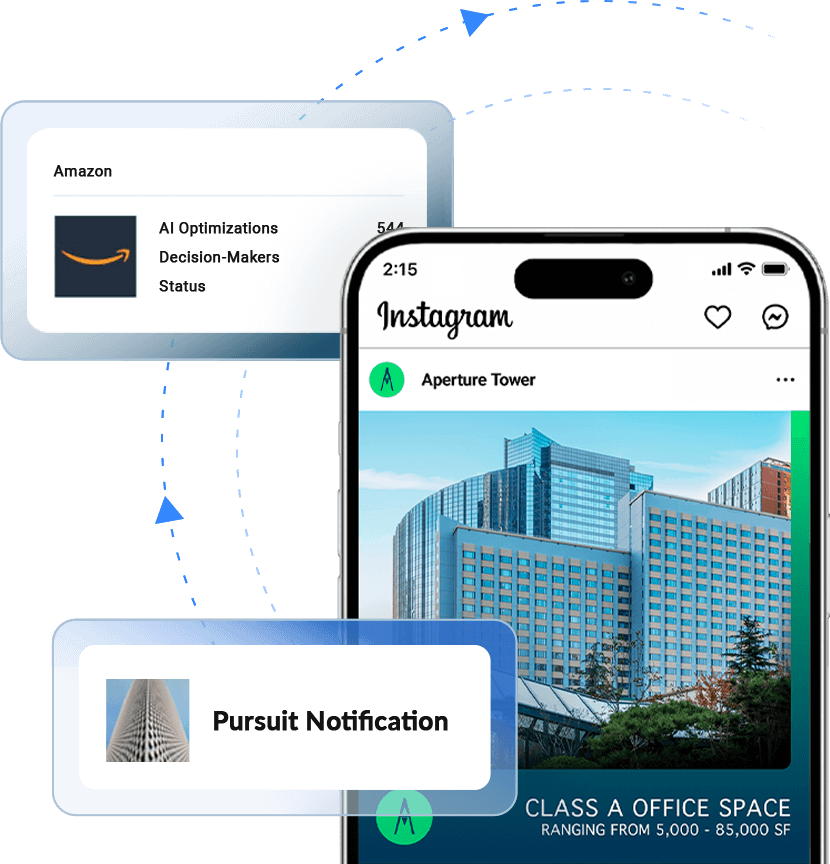

Leasing decisions now happen largely before a broker ever picks up the phone or a tour is scheduled. Brokers and tenants research assets digitally, compare options online, and form early preferences long before traditional outreach comes into play.

If an asset isn’t visible during that evaluation window, it’s effectively invisible. That reality is forcing a hard truth for Class A owners: strong buildings no longer win by default. They win by staying present throughout the entire decision cycle.

The AI Conversation—and Where It Breaks Down

AI became one of the most talked-about topics in CRE boardrooms in 2025. Nearly every platform promised smarter targeting, better results, or faster lease-up.

But when owners pressed for answers, clear ROI, measurable leasing impact, proof beyond impressions, the conversation often stalled. The issue isn’t skepticism about technology. It’s skepticism about outcomes.

Most owners aren’t asking if AI can help. They’re asking:

- Where does it actually fit in the leasing process?

- How does it impact tours and signed deals—not just clicks?

- And how do we prove it’s working?

Those questions matter because traditional tactics still reach only a fraction of the market. On average, broker-only strategies engage roughly 11% of brokers in a given market. That leaves the majority of active dealmakers and qualified tenants completely untouched.

Closing the Digital Gap Is Now a Leasing Requirement

What separated high-performing Class A assets in 2025 wasn’t experimentation; it was execution. Winning assets closed the digital gap by adopting strategies built specifically for commercial real estate, not borrowed from consumer marketing or retrofitted agency models.

They focused on three things:

Market intelligence, not guesswork.

Instead of broad outreach, they used real-time behavioral signals, broker activity, tenant expansion patterns, and lease expirations to identify who was actively in the market.

Continuous optimization, not static spend.

Budgets shifted automatically based on performance, ensuring dollars flowed to the channels and audiences generating real engagement, not vanity metrics.

Sustained engagement, not one-off campaigns.

They stayed visible before tours, after tours, and throughout extended decision cycles, addressing the reality that 86% of deals die after the initial walkthrough.

This wasn’t about “doing more marketing.” It was about doing the right marketing, consistently, measurably, and at scale.

What the 2025 Data Revealed

When Class A assets implemented CRE-specific, AI-driven digital strategies through platforms like Realtyads, the results were not incremental. They were structural.

Across 2025, these assets achieved:

- 4.8× improved broker reach in the first month

- 89% market broker coverage, compared to ~11% with traditional tactics

- 30% more property tours

- 18% more closed deals

- $874 returned for every $1 invested

These outcomes weren’t isolated to one market or one ownership group. They appeared consistently across portfolios, geographies, and leasing teams. More importantly, the gains were full-funnel. Awareness increased, consideration improved, tours rose—and deals closed at higher rates.

That’s the difference between digital marketing that looks good on paper and a digital strategy that moves occupancy.

Real-World Results, Not Theoretical Wins

The strongest signal from 2025 wasn’t just the data—it was how repeatable the results proved to be.

High-profile Class A assets in New York, Washington D.C., Chicago, San Francisco, and other major markets used sustained digital engagement to:

- Remain top-of-mind during year-long pursuits

- Differentiate in crowded competitive sets

- Reinforce value propositions long after tours concluded

- Attribute digital engagement directly to signed leases

In several cases, over 75% of closed deals involved meaningful digital interaction before execution. Decision-makers didn’t just tour the buildings; they encountered them repeatedly throughout their evaluation process.

What This Means for 2026

The Class A office market didn’t “recover” in 2025; it recalibrated. Growth flowed to assets that adapted to how leasing decisions are made today. And as we move into 2026, that divide is only widening.

Tenant decision cycles remain long. Broker attention is fragmented. Competition for quality tenants is intensifying in every major market. Assets that rely solely on traditional tactics will continue reaching the same small slice of the market. Assets that close the digital gap will control mindshare and outcomes.

The question for owners isn’t whether this shift is coming. It’s whether they’ll lead it or react to it.

See the Full Data Behind the Results

This article highlights the why. The full story—the benchmarks, case studies, and performance breakdowns—live in The 2025 Class A Office Leasing Report: How AI Delivered Measurable ROI.

👉 Download the full report to see the data, proof, and next steps.