The commercial real estate (CRE) market in 2025 is sending a clear message: investors are back in the game, but they are playing smarter. Acquisition activity this year reflects a market defined by selectivity, strategic repositioning, and a growing appetite for assets that align with shifting tenant needs and long-term market fundamentals.

According to the Financial Times, global CRE transaction values climbed 15% to reach $791 billion in the year through June. Yet, the number of deals actually slipped slightly. This signals a market where rising asset prices, not transaction volume, are driving growth. In other words, capital is chasing quality over quantity.

Big Players Are Making Strategic Moves

Some of the year’s biggest headlines point to where capital sees opportunity. Blackstone’s £489 million acquisition of Warehouse REIT strengthened its foothold in European logistics, a sector buoyed by e-commerce expansion. Meanwhile, in the U.S., the office market is showing signs of life for the first time in years. AI firms alone leased nearly one million square feet in San Francisco in the first half of 2025, fueling new development plans for high-profile office towers.

At the same time, CBRE forecasts a 10% increase in U.S. CRE investment activity by year-end, driven by interest rate stabilization and renewed institutional interest in logistics, office, and mixed-use assets. Agora’s latest investor survey reinforces this trend, with 84% of respondents favoring income-generating properties—especially multifamily and mixed-use—while nearly half are actively pursuing distressed or undervalued opportunities.

Taken together, these developments paint a picture of a market where confidence is cautiously returning, but with a sharper focus on resilience, adaptability, and long-term tenant demand.

What This Signals for the CRE Market

The message is clear: capital is flowing toward assets that promise stability and growth potential. Logistics and multifamily continue to lead the pack, while office assets with modern amenities and flexibility are seeing renewed interest, particularly in cities where tech and AI tenants are expanding. Distressed and undervalued properties are also attracting attention, as investors look to capture upside in a market that has spent two years finding its footing.

For building owners and asset managers, this means competition is no longer just about location—it’s about the story you can tell. Investors and tenants alike are prioritizing properties that demonstrate clear market positioning, operational efficiency, and adaptability to evolving demands.

How to Give Your Buildings a Competitive Edge

As acquisition activity accelerates, the question becomes: how do you ensure your properties stand out?

It starts with positioning. Buildings with updated infrastructure, tech-enabled operations, and flexible lease terms will naturally draw more interest from tenants and investors. Amenities tailored to evolving tenant expectations, whether that means collaborative spaces for office users or modernized units for multifamily renters, signal long-term value in a competitive market.

Data and digital strategy also play a critical role. Owners who leverage technology for marketing and tenant engagement can showcase their assets to the right audience at the right time. Adaptive reuse strategies, like converting underperforming office space into residential or medical properties—further demonstrate responsiveness to market demand and can unlock new sources of value.

Finally, in a market where ESG and climate resilience are gaining attention, buildings that meet evolving sustainability standards are better positioned to attract both capital and tenants seeking long-term security.

Where RealtyAds Fits In

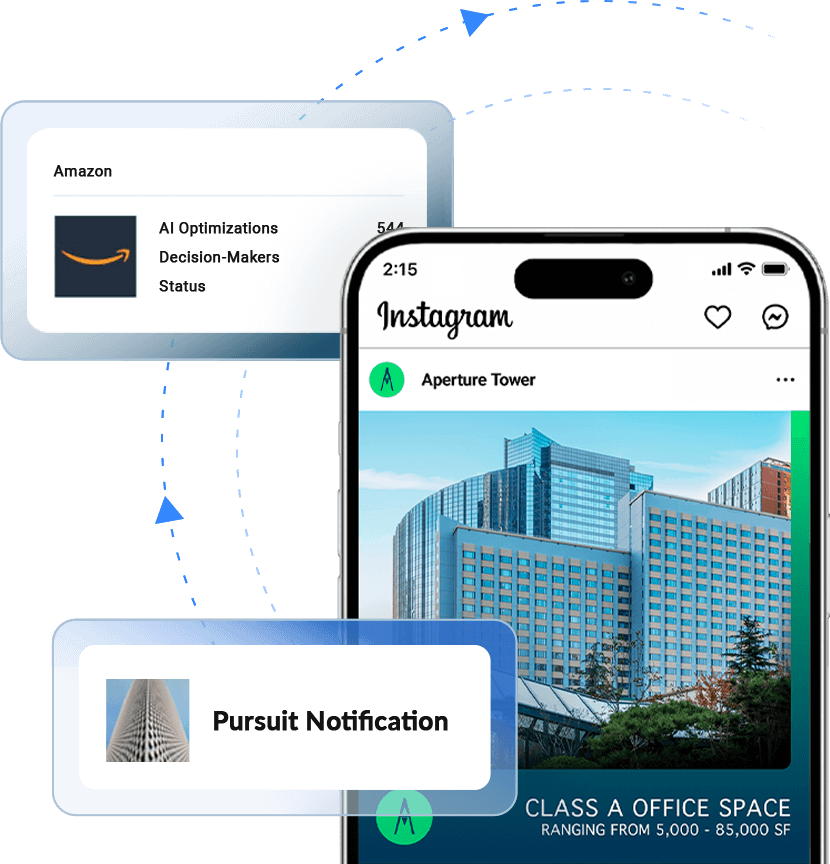

As investors grow more selective, buildings need more than a “For Lease” sign to compete, they need a digital strategy that amplifies visibility, builds credibility, and keeps properties top of mind with decision-makers. This is where RealtyAds helps owners gain a competitive edge.

By leveraging an AI-native platform, RealtyAds ensures your property reaches the right audience across digital channels with consistent, compelling messaging. Whether it’s promoting newly available space, highlighting recent upgrades, or positioning your building as the go-to choice for high-growth tenants, RealtyAds allows owners to control the narrative and drive demand in an increasingly crowded marketplace.

In a year defined by strategic acquisitions and rising competition, the buildings that will stand out are the ones telling the strongest story—backed by data, delivered with precision, and aligned with what today’s tenants and investors want most.