After several years of market adjustment, the trends shaping commercial real estate in 2026 reward focus, efficiency, and consistent visibility. Deal cycles remain complex, capital is selective, and decision-makers expect clarity earlier and more often. According to the Cushman & Wakefield 2026 U.S. Commercial Real Estate Outlook, market conditions are gradually stabilizing, with cautious optimism returning as capital activity improves and fundamentals reset. For CRE teams, success in 2026 won’t come from doing more. It will come from doing the right things, consistently.

These are the CRE trends to watch in 2026—and why they matter.

Visibility Becomes a Competitive Advantage

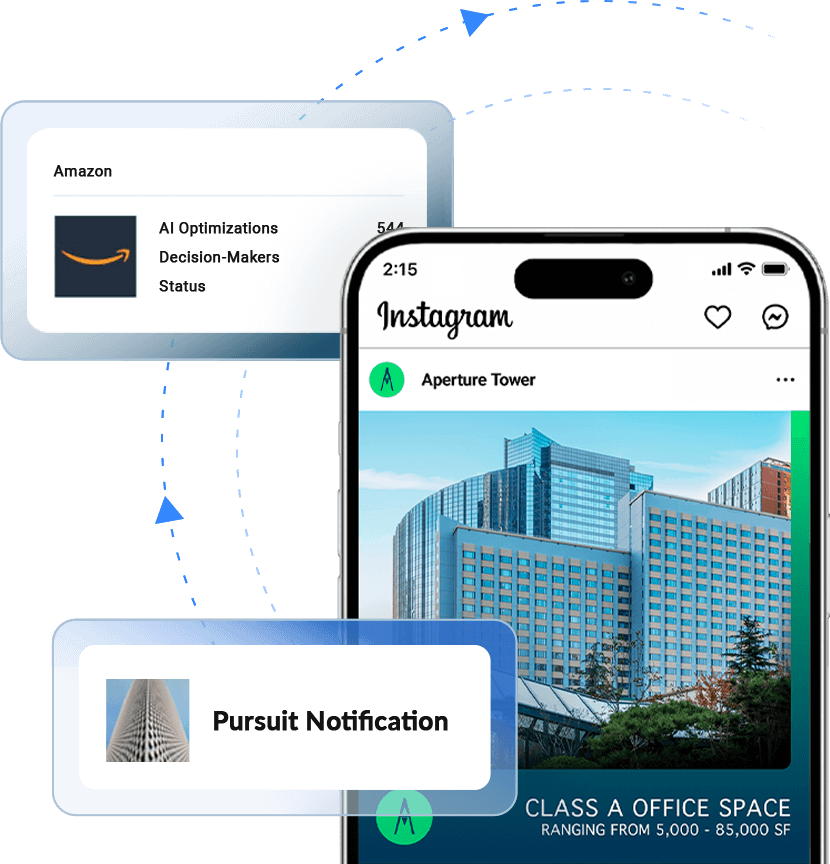

Visibility is no longer optional. One of the clearest shifts heading into 2026 is that assets maintaining consistent, targeted digital presence stay top-of-mind throughout long evaluation cycles.

This matters as supply conditions reset. Colliers’ 2026 Commercial Real Estate Outlook reports that industrial construction is down more than 60% from 2022 levels, while demand across logistics, manufacturing, and data-driven uses remains active in many markets. As new supply slows, competition increasingly centers on which assets are visible at the right moment—not just which ones exist.

In this environment, visibility isn’t about broad awareness. It’s about staying present with brokers and tenants already evaluating options—so when demand surfaces, your asset is already familiar.

Deal Cycles Stay Long, Expectations Don’t

Another defining trend for 2026 is the mismatch between extended deal cycles and rising expectations.

Leasing timelines remain long, particularly for office and large-format industrial. More stakeholders are involved, underwriting is more detailed, and approvals take longer. What’s changed is tolerance for friction. Decision-makers expect faster access to information, clearer positioning, and reinforcement throughout the entire pursuit—not just at the listing stage.

This trend highlights widening performance gaps between assets that clearly communicate value and those that fail to differentiate early.

Marketing and Leasing Finally Align

In 2026, the historical separation between marketing and leasing becomes a competitive disadvantage.

As capital markets stabilize and transaction activity gradually improves, teams are aligning messaging, data, and reporting so every interaction supports leasing outcomes. Marketing is no longer measured in isolation; it’s judged by how effectively it contributes to tours, negotiations, and signed deals.

This reflects a broader industry shift toward operational use of visibility and engagement data—not just reporting outputs.

Performance Proof Replaces Assumptions

Instinct still plays a role in CRE—but in 2026, it’s no longer enough on its own.

Owners and brokers increasingly expect measurable proof of what’s working: who is being reached, how prospects are engaging, and whether activity is moving deals forward. Engagement, reach, and conversion metrics are becoming standard decision inputs in a more cautious, data-driven market.

Efficiency Wins in a Cost-Conscious Market

Cost discipline remains a defining theme heading into 2026. But efficiency doesn’t mean cutting visibility—it means eliminating wasted exposure.

Budgets are being evaluated more closely, with greater emphasis on reaching in-market audiences rather than broad, unfocused impressions. Precision, not presence alone, is what sustains momentum.

Conclusion

CRE in 2026 rewards teams that combine visibility, data, and consistency. Assets that stay present, measurable, and aligned across marketing and leasing will be best positioned to move deals forward—regardless of market conditions.