Commercial real estate is moving faster than ever. Shifts in tenant demand, capital markets, and technology are reshaping how deals are sourced, marketed, and closed. The challenge isn’t access to information—it’s knowing where to focus your attention and how to turn insight into action.

Here’s what you need to know. Staying current in CRE requires a mix of trusted data, real-time signals, and practical insights from the field.

Start with Credible Market Data

Industry reports remain the foundation for understanding macro trends. Firms like CBRE, JLL, Cushman & Wakefield, and Colliers publish quarterly insights on vacancy, absorption, pricing, and demand across office, industrial, and multifamily.

These reports help answer high-level questions:

- Where is demand accelerating—or stalling?

- How are leasing timelines shifting?

- Which asset classes are outperforming?

The key is consistency. Following the same sources quarter over quarter allows you to spot patterns, not just headlines.

Follow Broker and Owner Activity—not Just News

Market conditions don’t change in theory; they change in practice. Pay close attention to what brokers, asset managers, and owners are sharing on LinkedIn and in industry newsletters.

Leasing announcements, deal commentary, and firsthand reflections often surface weeks before trends show up in formal reports. These insights reveal:

- How competitive leasing environments really are

- What’s influencing tenant decisions today

- Where deals are getting stuck in the funnel

This on-the-ground perspective adds context that static data alone can’t provide.

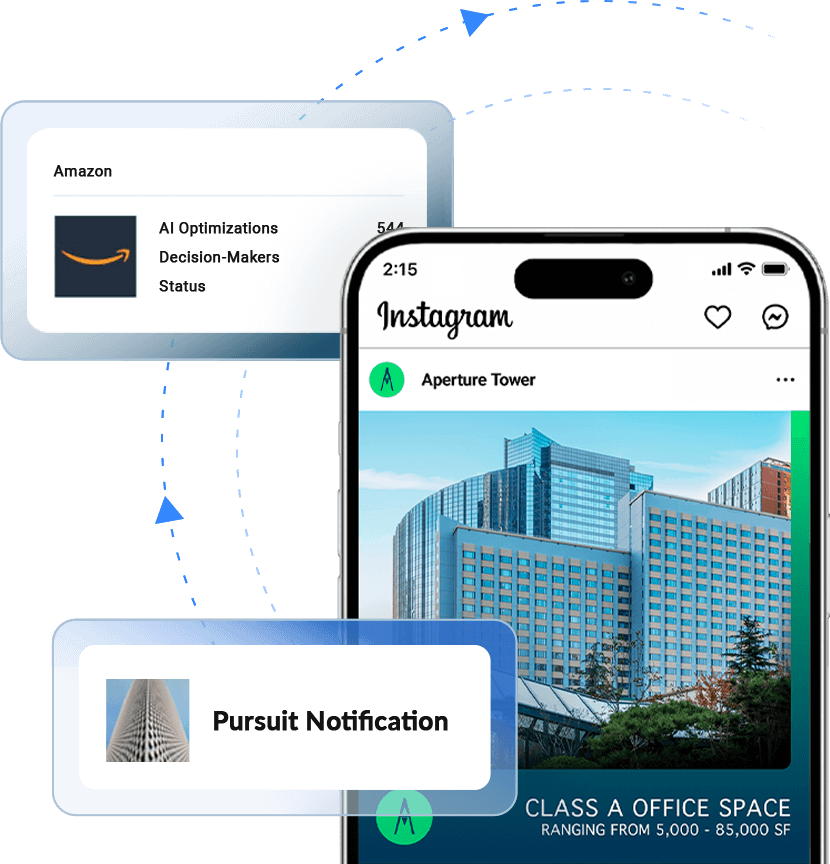

Track Digital Engagement Signals

Modern leasing is increasingly digital—and that means behavior leaves a trail. Monitoring how brokers and tenants engage online provides early indicators of shifting interest.

Metrics like search activity, listing engagement, ad interaction, and time-on-site show where attention is moving long before a tour is scheduled. Digital visibility data helps teams understand:

- Which markets and property types are gaining momentum

- How early-stage demand is forming

- Whether marketing efforts are actually influencing leasing velocity

In a long sales cycle, these signals matter.

Attend Webinars and Industry Events with a Purpose

Webinars, panels, and conferences remain valuable—but only when approached strategically. Prioritize sessions focused on performance, outcomes, and applied strategy, not just predictions.

The most useful conversations center on:

- What’s working right now

- Where traditional approaches are underperforming

- How teams are adapting their leasing and marketing playbooks

Treat events as an extension of your research, not a replacement for it.

5. Leverage AI-Driven Insights to Cut Through the Noise

The volume of CRE content is growing, but clarity is harder to find. AI-enabled platforms can synthesize data across markets, channels, and audiences—highlighting what actually impacts results.

Rather than reacting to every headline, AI helps teams:

- Identify meaningful shifts in engagement

- Measure what’s influencing deals

- Focus time and budget where it matters most

This turns trend-tracking into a competitive advantage, not a distraction.

Conclusion

Staying up-to-date in commercial real estate isn’t about tracking every headline—it’s about knowing which signals actually matter and how early you can act on them.

Credible market data, real-world insight from brokers and owners, and digital engagement signals all play a role. But as leasing cycles lengthen and competition intensifies, many teams are finding that traditional trend-tracking methods alone aren’t enough to keep pace.

Technology is beginning to change how those signals are surfaced and interpreted. AI, in particular, is helping CRE teams move beyond periodic updates toward more continuous insight.